Banks and law enforcement agencies in a joint campaign against “financial mules” for an eighth time

Financial institutions and law enforcement agencies from 25 countries have been working together for the seventh consecutive year to counter money laundering and “financial mule” schemes. These individuals have a key role to play in the process of laundering of funds obtained through a wide range of online scams, such as the very popular recently phone scams, phishing scams with e-mails that mimic real sites, e-commerce fraud, sim-swapping, social engineering, man in the middle attacks and more. The global campaign is organized by the European Cybercrime Center at Europol / EC3 – EUROPOL/ with the partnership of the European Banking Federation of which the ABB is a member.

This year’s campaign resulted in the identification of more than 8 755 money mules alongside 222 money mule recruiters, of which 2 469 were arrested according to Europol. 1 648 criminal investigations were open. More than 1 800 banks and other financial institutions helped to report 4 000 fraudulent money mule transactions, preventing a total loss of EUR 17.5 million.

During this year’s campaign, the Bulgarian law enforcement identified 104 “financial mules” and 8 recruiters, as well as 38 victims of those criminal activities. In relation with the fight against financial crimes in our country with the help of banks in Bulgaria 104 illegal transactions with a total value of around EUR 1.5 million were prevented.

A financial “mule” is a person who transfers illegally acquired funds between different bank accounts, often in different countries, and receives a commission for this activity. According to Europol statistics, in 95% of cases “financial mules” are used to obtain misappropriated financial resources acquired from previous cybercrime. Often the funds are intended to finance other criminal activities and money laundering.

Recruiters of money mules are coming up with ingenious ways to lure in their victims. For example, cases involving romance scams were reported on the rise, with criminals increasingly recruiting money mules on online dating sites, grooming their victims over time to convince them to open bank accounts under the guise of sending or receiving funds. Criminals are also more and more turning to social media to recruit new accomplices through get-rich-quick online advertisements, targeting students and young adults. Criminals are taking advantage of real events, in order to make their proposals sound more realistic. They aim at attracting representatives of the most vulnerable groups who need money – students, people who have lost their jobs and others. The recruiters often use information about their victims received by social media.

It is important to know that even if the persons used as “financial mules” are not aware that they are involved in illegal money laundering activities, they are committing a crime by transferring funds and this can have severe consequences for them.

The banking sector in Bulgaria supports the efforts of law enforcement authorities and actively cooperates with them in preventing and detecting financial crimes related to the laundering of funds obtained from illegal activity. Banks have strict rules and requirements to identify their customers, thanks to which they also benefit from high level of trust among consumers of financial services.

#DontbeaMule

Have you ever been asked to help transfer money by:

- An online friend or love interest?

- Someone offering a way to make easy money?

- Someone claiming to need help as they can’t use their own bank account?

If yes, you may have been talking to a money mule recruiter – and if you did what they asked, you may have committed a crime.

To raise awareness of this type of fraud, the money muling awareness campaign #DontbeaMule kicks off today across Europe. The awareness-raising materials on the ABB website inform the public about how these criminals operate, how the customers can protect themselves and what to do if they or their acquaintances become a victim of money laundering schemes.

Do you think you might be used as a mule? Act now before it is too late: stop transferring money and notify your bank and your national police immediately.

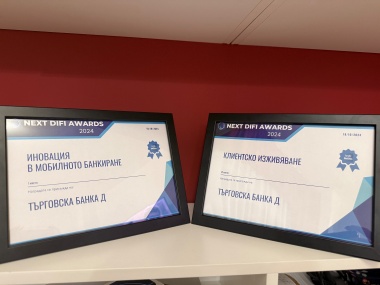

DBank

DBank